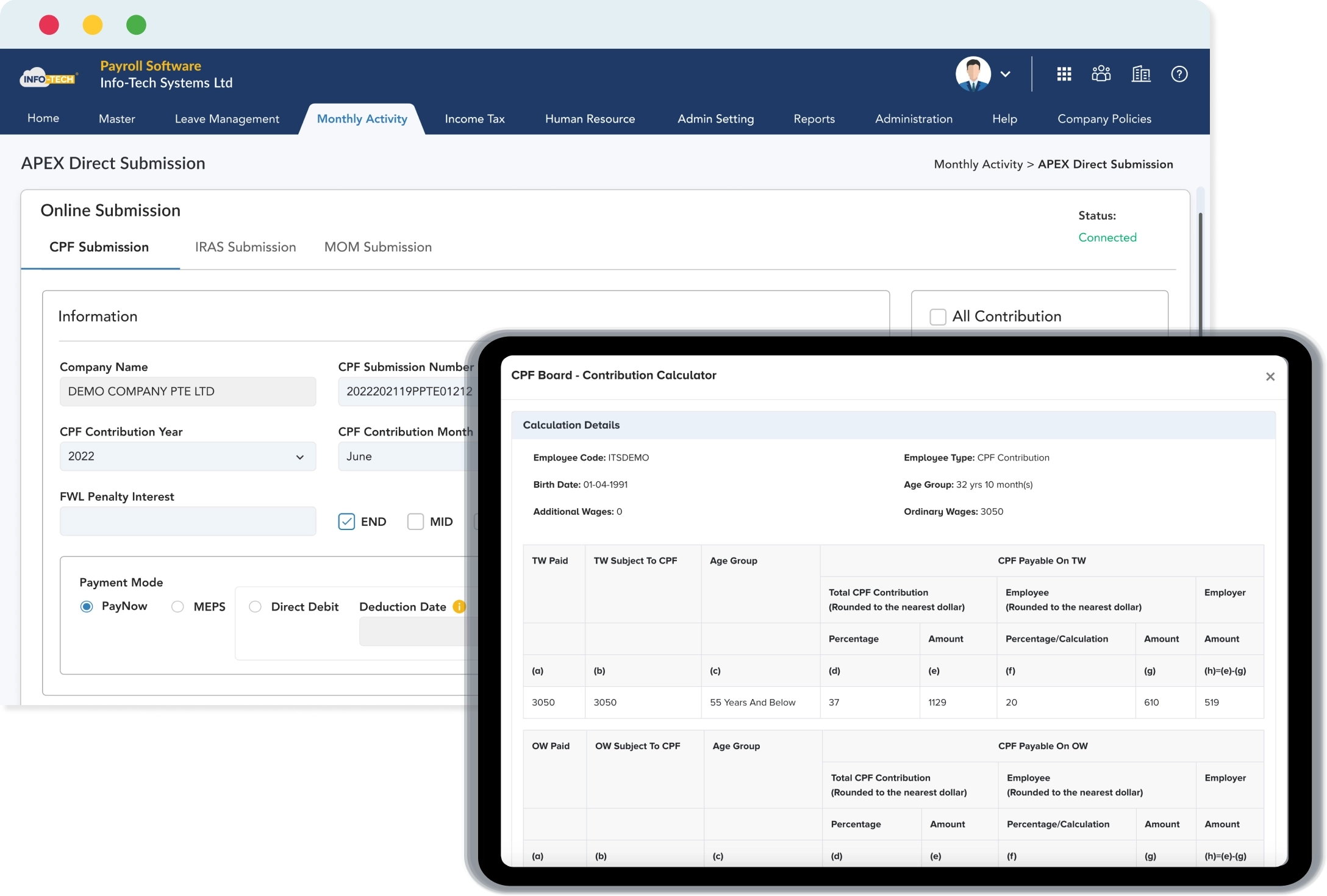

The Central Provident Fund (CPF) is a compulsory savings scheme in Singapore for citizens and PRs, where employers and employees make contributions based on several criteria, including salary and age. Whether you're an employee or employer, our CPF Calculator is here to make CPF contribution calculations easy.

Stay updated on the latest CPF contribution rates and calculate your monthly contributions effortlessly. Take control and accurately determine the contribution payable based on your monthly salary with Info-Tech's user-friendly CPF Calculator!

CPF Calculator

CPF Details

CPF contribution

| Employee CPF Contribution | |

| Employer CPF Contribution | |

| SDL | |

| Net Salary |

Detail

| Total CPF | |

| Employee's Share of CPF Contribution | |

| Employer's Share of CPF Contribution |

Stay up to date with the latest information on CPF, including contribution rates, salary ceilings, and more.

CPF Contribution Calculator FAQs

Is CPF 20% of salary?

Yes. If you are a Singapore Citizen or PR aged 55 and below, 20% of your monthly salary is taken from your pay and put into CPF

Your employer also contributes another 17%, so in total, 37% of your salary goes into CPF. The employer’s portion does not affect your take-home pay.

How much CPF will I get after 55?

Once you turn 55, CPF contributions do not stop, but they gradually reduce.

Between ages 55 and 60, the total CPF contribution becomes 32.5%.

From 60 to 65, it drops further to 23.5%.

After 65, the rates reduce again. This is meant to help older workers take home more pay.

How much CPF is deducted every month?

For most employees aged 55 and below, 20% of your monthly salary is deducted for CPF.

The exact amount depends on:

- Your age

- Your salary

- Your CPF wage ceiling

Your employer’s CPF contribution is added separately and does not reduce your salary

What is the maximum CPF contribution per month in 2025?

In 2025, CPF is calculated only on the first SGD 6,800 of your monthly salary. This means the maximum total CPF contribution per month (employee + employer) is about SGD 2,516 if you are 55 or below.

If you earn more than SGD 6,800, the extra amount is not subject to CPF.

How much can I withdraw from CPF after age 55?

When you turn 55 , you can withdraw any CPF savings above the Full Retirement Sum (FRS).

The FRS must first be set aside in your Retirement Account.

How much you can take out depends on:

- Your total CPF savings

- Whether you own property

- Whether you choose to keep more CPF for monthly payouts

Withdrawals are not automatic — you need to apply through CPF Board.